Fernando Alcoforado*

This article aims to demonstrate that the current inflation in the world economy can lead to the collapse of contemporary economic and financial globalization. Inflation is defined as the continuous, persistent and widespread increase in prices in general. Economic and financial globalization is defined as the economic interdependence between countries around the world, resulting from an increasing volume and variety of cross-border transactions in goods and services, as well as greater mobility of factors of production, including a wide range of international diffusion of capital and technology. With the persistence of inflation, economic and financial globalization will collapse because the world does not have a global governance capable of coordinating the action of countries in the fight against inflation and the world economy will be affected by the recession resulting from the increase in interest rates adopted by the governments of all countries in the world to control it. Global inflation and global recession will cause the world to face global stagflation that will lead to the collapse of economic and financial globalization when many national governments will abandon it so as not to be driven, too, into economic collapse.

Inflation in the set of OECD (Organization for Economic Co-operation and Development) countries, which are 38 in total, reached 8.8% in March 2022 in 12 months, compared to 2.4% in March 2021. According to the OECD, it was the sharpest increase since October 1988. About one-fifth of OECD countries recorded double-digit inflation, with the highest rate in Turkey. Inflation measured by the Broad National Consumer Price Index (IPCA) reached 11.3% in the 12 months through March 2022 in Brazil. In Turkey, the rate is 61.1% and in Argentina, 55.1%. OECD report shows that Brazil has the third highest inflation among the G20 countries, a group of the largest economies in the world, behind only Turkey and Argentina [IBET. Brasil tem 3ª maior inflação entre as grandes economias, mostra OCDE. Na conjunto de países do grupo G20, taxa em 12 meses atingiu 7,9% em março, contra 11,3% no Brasil; veja ranking (Brazil has the 3rd highest inflation among large economies, shows OECD. In the group of countries in the G20 group, the 12-month rate reached 7.9% in March, against 11.3% in Brazil; see ranking). Available on the website <https://www.ibet.com.br/brasil-tem-3a-maior-inflacao-entre-as-grandes-economias-mostra-ocde-na-conjunto-de-paises-do-grupo-g20-taxa-em-12-meses-atingiu-79-em-marco-contra-113-no-brasil-veja-ranking/>]. The current inflation can be explained by the disorganization of world production caused by the pandemic of the new coronavirus and by the western economic sanctions against Russia for the war in Ukraine, which resulted in problems in the supply for the whole world of fuel, food and inputs both from Russia and from Ukraine, major world suppliers.

Before the war, Russia and Ukraine were responsible for 30% of global wheat exports. In addition, alongside Belarus, Russians accounted for 40% of fertilizer sales worldwide. Now the prices of grains, corn and fertilizers are rising. The price of wheat on the global market rose by almost 60%. In Africa and the Middle East supplies are running low. International Monetary Fund (IMF) Managing Director Kristalina Georgieva considered that Russia’s war against Ukraine is causing disruption to global trade, particularly in energy and grain, that threatens to cause a food shortage in Africa and the Middle East, weakens the growth prospects of most countries and causes high inflation dangerous for the global economy [VALOR. Guerra na Ucrânia e inflação são ‘perigo’ para economia global e vão gerar mais fome, diz FMI [War in Ukraine and inflation are ‘danger’ to global economy and will generate more hunger, says IMF). Available on the website <https://valor.globo.com/google/amp/mundo/noticia/2022/04/14/guerra-na-ucrania-e-inflacao-sao-perigo-para-economia-global-e-vao-gerar-mais-fome-diz-fmi.ghtml>]. She claims that chronically high inflation is forcing central banks around the world to raise interest rates, slowing economic growth, which amounts to a major setback for the global recovery. Georgieva says the threat of a breakdown in global cooperation cannot be underestimated.

Part of the disturbances is due to Russia’s war against Ukraine, but another part is due to Western sanctions against Russia, which have pushed up, above all, oil prices on the international market. Economic sanctions against Russia must not end the war. The main effect is inflation. The scarcity of fuel, food and supplies around the world contributed to the insufficiency in the supply of these products, resulting in the vertiginous rise of their prices in the international market, affecting the economy of all countries in the world. It is, therefore, a problem of demand inflation that, in order to be solved, there would need to be a global and coordinated planning of the increase in the production of scarce products in all producing countries to force their prices down. This would be the solution that would prevent the collapse of contemporary economic and financial globalization. However, it would only be possible if there was an entity exercising global governance to coordinate the action of producing countries with a view to increasing the production of scarce products. This entity does not exist on the planet and would not be implemented because it would be incompatible with the neoliberal model prevailing throughout the world economy whose ideologues do not admit the government intervention in the economy. In view of this fact, the inflation of demand for scarce products should continue feeding, also, the inflation of the production costs of other products.

Inflation in the production costs of products in general is occurring simultaneously with the inflation of demand for scarce products. This inflation occurs when there is an increase in production costs (machinery, raw materials, inputs, labor and taxes) of other products. Production cost inflation can be generated by increasing any of the production costs such as wages, machinery, raw materials, inputs or taxes. With the increase in production costs, the reaction of producers is to increase the price of products and services, which becomes higher for the final consumer. Therefore, under these circumstances, the world economy is also faced with an inflation of production costs. What would be the rational way to eliminate production cost inflation in the world? To eliminate production cost inflation, governments of all countries in the world should adopt measures to encourage increased productivity to avoid rising prices for wages, raw materials and inputs and to reduce taxes on products. This type of initiative would be incompatible with the neoliberal model prevailing throughout the world economy, which does not admit government intervention in the economy. Instead of adopting these measures, governments act to increase interest rates that, in addition to not effectively lowering inflation, contributes to bringing their economies into recession. The global recession will be the natural consequence of the increase in interest rates adopted by all countries in the world. Global inflation and global recession will cause the world to face global stagflation and will lead many national governments to abandon neoliberal globalization.

UN Secretary-General António Guterres said the war between Russia and Ukraine exacerbated a number of problems for the global economy. Inflation is rising, purchasing power is eroding, growth prospects are weakening and development is stalling. Guterres added that many developing countries are “running into debt” amid escalating sovereign bond yields. This is causing a potential vicious cycle of inflation and stagnation, the so-called stagflation [CNN BRAZIL. Guerra na Ucrânia exacerba desafios da economia global, como inflação, diz ONU (War in Ukraine exacerbates global economic challenges such as inflation, says UN). Available on the website <https://www.cnnbrasil.com.br/business/guerra-na-ucrania-exacerba-desafios-da-economia-global-como-inflacao-diz-onu/?amp>].

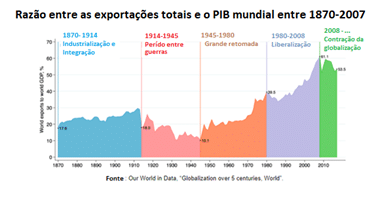

he signs of the collapse of economic and financial globalization were already showing from 2010 when the ratio between world exports and world GDP fell by around 12%, a decline not seen since the 1970s. It can be observed that globalization evolved from 1870 to 1914, declined between 1914 and 1945 (between world wars) and resumed from 1945 to 2008. As of 2008, globalization began to decline with the fall in the ratio between world exports and GDP world. Inflation with the current world recession is expected to further exacerbate the decline in the globalization process.

Figure 1- Ratio between total exports and world GDP between 1870 and 2007

Source: https://aterraeredonda.com.br/acabou-o-impulso-de-globalizacao/

Michael Roberts, économiste, co-éditeur, entre autres livres, de “The Great Recession : a Marxist View”, “The Long Depression” et “Marx 200 : a Review of Marx’s Economics 200 years after his Birth” et auteur du blog « La prochaine récession » (https://thenextrecession.wordpress.com), states in his article Acabou o impulso de globalização? (Is the globalization impulse over?), available on the website <https://aterraeredonda.com.br/acabou-o-impulso-de-globalizacao/>, that the last wave of globalization began to subside shortly before of the early 2000s, when global profitability began to decline, as shown in Figure 2 below for the average profit rate of the G20 countries, which is composed of the countries of the European Union, in addition to the following countries: Argentina, Australia, Brazil , Canada, China, France, Germany, India, Indonesia, Italy, Japan, Republic of Korea, Mexico, Russia, Saudi Arabia, South Africa, Turkey, United Kingdom and United States

Figure 2- Average profit rate of the G20 countries (%)

Source: https://aterraeredonda.com.br/acabou-o-impulso-de-globalizacao/

The end of economic and financial globalization represented by the relationship between world exports and world GDP may occur, not only due to world stagflation, but also because of the fall in the global profitability rate ratio, as shown in Figure 2. It should be noted that From the 1980s onwards globalization meant the breaking of tariff barriers, quotas and other trade restrictions, thus allowing multinationals to operate freely and transfer their investments to areas of cheap labor in order to increase profitability. The assumption was that this would lead to global expansion and the harmonious development of the productive forces and growth of the world’s resources that, in fact, did not happen. In the 1990s, world trade grew by 6.2% per year, foreign direct investment (FDI) increased by 15.3% per year, and global GDP rose by 3.8% per year. However, in the long depression of the 2010s, trade grew by just 2.7% a year, slower than GDP by 3.1%, while FDI increased by just 0.8% a year. The result of globalization has been the destruction of all the old established national industries and, in place of the old local and national self-sufficiency, interdependence between nations has been established. The interdependence between nations, which was one of the strengths of globalization, has now turned into its opposite, contributing to the spread of inflation in every country on the planet.

It can be said that economic and financial globalization and free trade have not brought gains for all companies, all countries, and their populations. Under the free movement of capital belonging to transnational corporations, as well as under free trade without tariffs and restrictions, the most efficient large capitals triumphed at the expense of the weakest and most inefficient. As a result, workers in these latter sectors were also affected. Transnational corporations moved their activities to areas where labor was cheaper and adopted new technologies that require less labor in the struggle for profitability. Instead of harmonious and egalitarian development, globalization has increased inequality of wealth and income, both between and within nations. With the collapse of globalization, it is unlikely that capitalism will gain a new lease of life based on growing and sustained profitability. Capitalism is unlikely to regain past profitability in the face of the prospect of a deepening current crisis and perhaps more wars in the future. The collapse of economic and financial globalization is inevitable. This means that each country in the world should promote its development aimed at its internal market with the adoption of national developmentalist economic policies so as not to suffer the same collapse that economic and financial globalization will have.

* Fernando Alcoforado, 82, awarded the medal of Engineering Merit of the CONFEA / CREA System, member of the Bahia Academy of Education, the SBPC- Brazilian Society for the Progress of Science and IPB – Polytechnic Institute of Bahia, engineer and doctor in Territorial Planning and Regional Development from the University of Barcelona, university professor and consultant in the areas of strategic planning, business planning, regional planning, urban planning and energy systems, was Advisor to the Vice President of Engineering and Technology at LIGHT S.A. Electric power distribution company from Rio de Janeiro, Strategic Planning Coordinator of CEPED- Bahia Research and Development Center, Undersecretary of Energy of the State of Bahia, Secretary of Planning of Salvador, is author of the books Globalização (Editora Nobel, São Paulo, 1997), De Collor a FHC- O Brasil e a Nova (Des)ordem Mundial (Editora Nobel, São Paulo, 1998), Um Projeto para o Brasil (Editora Nobel, São Paulo, 2000), Os condicionantes do desenvolvimento do Estado da Bahia (Tese de doutorado. Universidade de Barcelona,http://www.tesisenred.net/handle/10803/1944, 2003), Globalização e Desenvolvimento (Editora Nobel, São Paulo, 2006), Bahia- Desenvolvimento do Século XVI ao Século XX e Objetivos Estratégicos na Era Contemporânea (EGBA, Salvador, 2008), The Necessary Conditions of the Economic and Social Development- The Case of the State of Bahia (VDM Verlag Dr. Müller Aktiengesellschaft & Co. KG, Saarbrücken, Germany, 2010), Aquecimento Global e Catástrofe Planetária (Viena- Editora e Gráfica, Santa Cruz do Rio Pardo, São Paulo, 2010), Amazônia Sustentável- Para o progresso do Brasil e combate ao aquecimento global (Viena- Editora e Gráfica, Santa Cruz do Rio Pardo, São Paulo, 2011), Os Fatores Condicionantes do Desenvolvimento Econômico e Social (Editora CRV, Curitiba, 2012), Energia no Mundo e no Brasil- Energia e Mudança Climática Catastrófica no Século XXI (Editora CRV, Curitiba, 2015), As Grandes Revoluções Científicas, Econômicas e Sociais que Mudaram o Mundo (Editora CRV, Curitiba, 2016), A Invenção de um novo Brasil (Editora CRV, Curitiba, 2017), Esquerda x Direita e a sua convergência (Associação Baiana de Imprensa, Salvador, 2018), Como inventar o futuro para mudar o mundo (Editora CRV, Curitiba, 2019) and A humanidade ameaçada e as estratégias para sua sobrevivência (Editora Dialética, São Paulo, 2021).